- Home

- Technical Analysis

- Why Is Chainlink Price Up Today?

Why Is Chainlink Price Up Today?

- Chainlink price breakout from the $20 resistance trendline of the cup and handle pattern signals its exit from a 6-month accumulation trend.

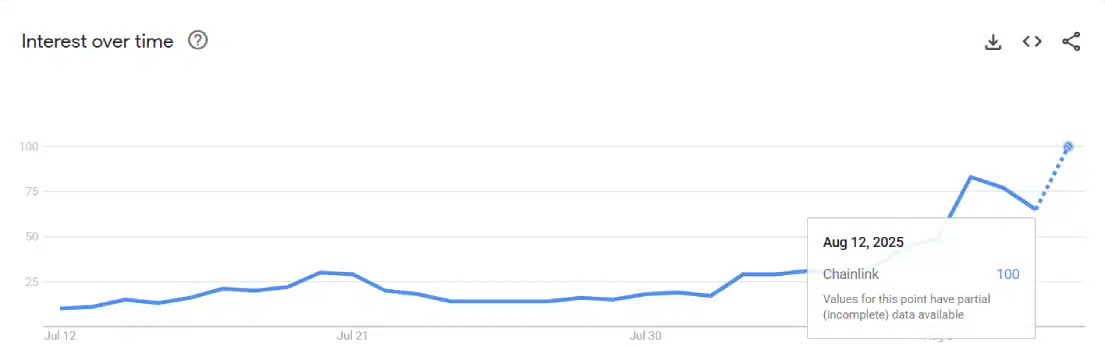

- ‘Chainlink’ search volume has been steadily trending in Google Trends in the last two weeks.

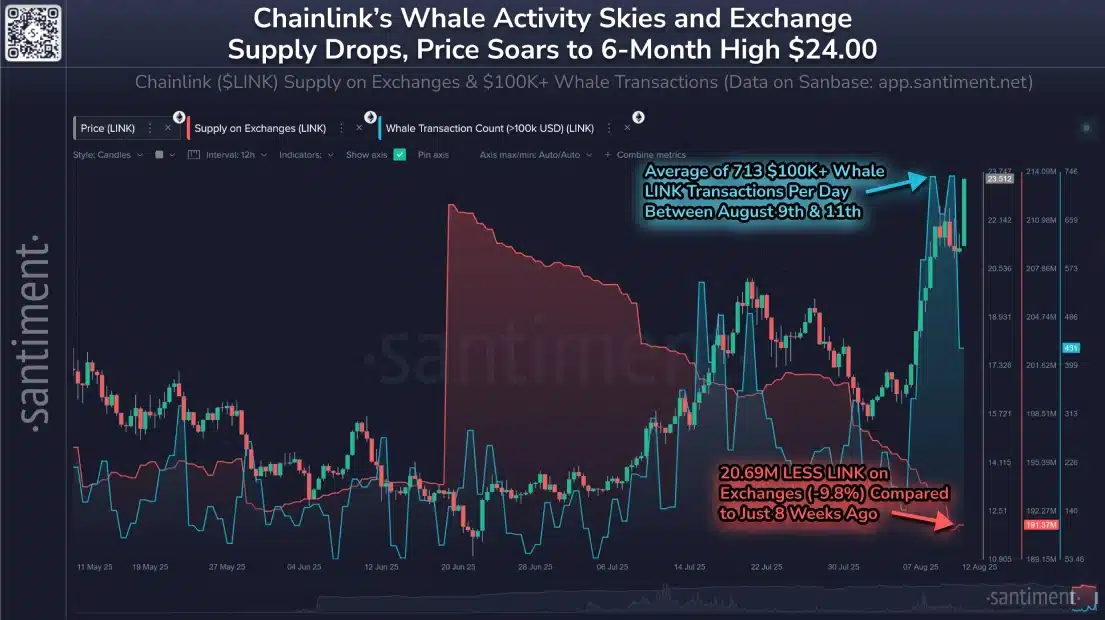

- On-chain data highlights that the whale transactions have spiked to 713 per day in the recent rally, while the LINK’s exchange supply has dropped 10% in the last 8 weeks.

LINK, the native cryptocurrency of the decentralized oracle network Chainlink, recorded a sharp upsurge of +15% during Tuesday’s U.S. market hours to trade at $23.25. While the buying pressure aligns with renewed bullish momentum in the altcoin market, LINK coin climbed high in Google Trends amid a steady accumulation trend from high-net-worth investors. Will the rising price push for the $30 psychological level?

Google Trends Shows Surge in Chainlink Interest

Over the past week, the Chainlink price showed a high momentum rally from $15.4 to the current trading value of $23.2, accounting for a 50% gain. Subsequently, the asset’s market cap has bounced to $15.71 billion.

This bullish upswing gained momentum from the recent announcement of Chainlink’s partnership with ICE and the launch of the strategic LINK Reserve.

Along with this news-driven momentum, this Chainlink price upswing was backed by a sharp increase in trading volume, accentuating a strong conviction from buyers to sustain higher prices.

According to Google Trends, the search volume for ‘Chainlink’ has spiked dramatically over the past week, with the highest value recorded on August 12, 2025, at 8.30 pm, hitting its peak of $100 in interest. This upsurge suggests that the bullish momentum is not just confined to the market but is also being mirrored by growing public interest.

The chart below shows a consistent rise since August 1st, with notable interest spikes during price breakouts, suggesting that retail investors are waking up to the potential of Chainlink as the recovery trend strengthens.

LINK Price Boosted by Growing Whale Interest and Reduced Exchange Supply

Another contributor to the recent price recovery is the increase in whale transactions and the decrease in exchange supply. In a recent tweet, the crypto analytics platform Santiment highlighted that whale transactions have spiked to 713 per day between August 9th and 11th.

This sharp rise in whale activity reflects growing institutional and large-scale investors in this cryptocurrency.

Meanwhile, the supply of Chainlink on the exchange has dropped nearly 10%, meaning 20.98 million LINK has been removed from the trading platform compared to the past 8-week high. This reduced supply available for selling on the exchange strengthens the stability in the market and bolsters the bullish momentum in price.

The metrics above emphasize the growing demand for Chainlink in a stable environment, which bolsters its price for a higher rally.

Chainlink Price Exits 6-Month Accumulation Trend

The daily chart analysis of Chainlink price shows the completion of a traditional reversal pattern called a cup and handle. The chart setup displays a long U-shaped accumulation trend followed by a temporary pullback to recuperate its exhausted push momentum.

Amid the price recovery, the coin price provided a decisive breakout from the pattern’s neckline resistance of $20 on August 9th. A sharp upward incline of the daily exponential moving average (20, 50, 100, and 200) further reinforces the rising bullish sentiment in the market.

If the pattern holds true, the coin price is poised for another 31% surge to hit the December 2024 high of $30.

However, the anticipated rally could face overhead supply at a key resistance of $27.22. This resistance could drive an occasional pullback in LINK price to recoup the exhausted bullish momentum.

Also Read: Ethereum Price to Hold $4,000 as Corporate Adoption Grows

Sahil Mahadik

As a full-time trader with over three years of hands-on experience in the financial markets, I have honed an exceptional proficiency in technical analysis, which is the cornerstone of my daily monitoring of price fluctuations in leading assets and indices. My journey into trading began with a deep fascination for financial instruments, and this curiosity naturally expanded into the ever-evolving world of cryptocurrencies. I am currently contributing to CryptoNewsZ and have also written for Coingape, The Coin Republic and TheMarketPeriodical. I am driven by my passion for the markets and want to explore new opportunities, I analyze emerging trends and strategies to get maximum returns in traditional and crypto markets.Recent Post

All latest news-

Notice: Trying to access array offset on value of type bool in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

Notice: Trying to get property 'term_id' of non-object in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

-

Why Did Bitcoin Price Fall Today and What’s Next?

2 months ago