- Home

- Technical Analysis

- Chainlink Price Exits an 6-Month Accumulation with this Breakout; $30 next?

Chainlink Price Exits an 6-Month Accumulation with this Breakout; $30 next?

- Chainlink price exits a 6-month accumulation trend amid the formation of a cup and handle reversal pattern.

- On-chain data highlights that crypto whales have accumulated over 8.10 million LINK in the last two weeks.

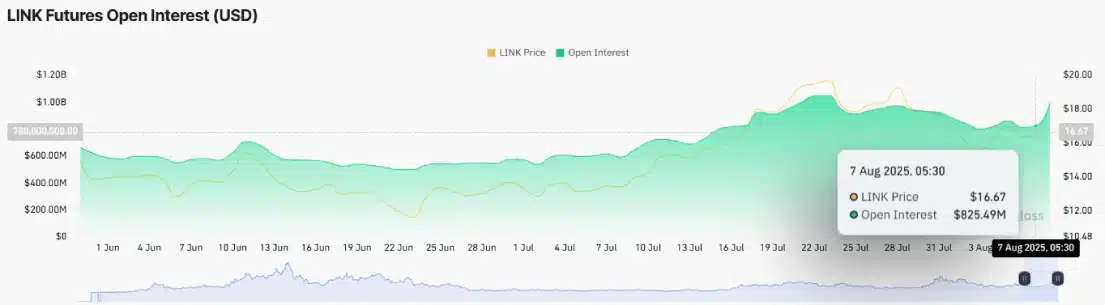

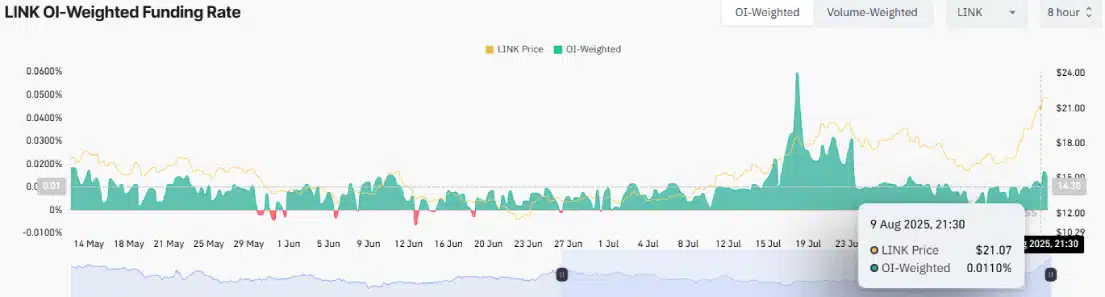

- LINK futures open interest bounced to $986.5 million, while the funding rate holds a positive value at 0.0167%, projecting strong conviction from derivative trade for a potential price rally.

LINK, the native cryptocurrency of the decentralized oracle network Chainlink, recorded a 0.2% jump on August 10th. The buying pressure followed renewed recovery sentiment in the border crypto market after a brief correction last week. However, the Chainlink price gained additional momentum as the derivative market data highlighted renewed interest from futures traders and active accumulation from whales. The bullish upswing also provides a decisive breakout from a traditional reversal pattern, ending a 6-month accumulation trend. Is the LINK price heading for a $30 leap?

Derivative Market Data Shows Renewed Bullish Interest

Since last week, the Chainlink price has experienced a high-momentum rally from $15.43 to the current trading value of $22. With the 42% growth, LINK emerged among the highest gainers in the weekly chart of the top 100 cryptocurrencies, currently holding a market cap of $14.9 billion.

The upswing aligns with broader market recovery after a brief correction last week that recuperated the exhausted bullish momentum.

Along with the price rally, the LINK futures open interest bounced from $800.8 million to $986.5 million, registering a 22% gain. This increase suggests growing conviction in the ongoing uptrend, as more traders are opening and holding positions in anticipation of further rallies.

More capital inflow into the futures market highlights the traders’ growing conviction, which may act as a precursor for heightened volatility.

Additionally, the OI-weighted funding rate has started to project an upward inclined current stand at 0.0167%. This shift reflects that long-position holders are increasingly willing to pay shorts to maintain their leverage. The rising funding rate typically indicates that the buying pressure is dominant.

Adding to the bullish note, the Chainlink price recovery is also fueled by active accumulation from high-net-worth investors. In a recent tweet, market analyst Ali Martinez highlighted that the crypto whale bought over 8.10 million LINK (worth approximately $150 million) in the last 2 weeks.

The steady accumulation despite the short-term volatility highlights the whales’ conviction in the assets’ long-term growth.

If the current momentum in both the spot and derivatives markets persists amid whale support, the LINK price could likely hold its recent breakout from $20.3 to drive a higher rally.

Chainlink Price Completes Cup and Handle Pattern

The daily chart analysis of Chainlink price shows the completion of a traditional reversal pattern called Cup and Handle. The chart setup is characterized by a long U-shaped accumulation trend followed by a temporary pullback to recuperate the exhausted bullish momentum before the next leap.

Since mid-February, this pattern has carried a long accumulation trend before the neckline resistance of $20.3. On August 9th, the coin had a decisive breakout at the neckline resistance to signal a major change in market dynamics. The bullish alignment with the exponential moving average (20, 50, 100, and 200) accentuates the broader bullish trend in price.

However, with the intraday gain of 0.2%, the daily candle shows a long wick rejecting on either side, indicating a slowdown in bullish momentum and risk for bearish pullback potential support. The price reversal could retest the breached trendline to potential support. If the level holds, the $30 level could become a magnet for the LINK price, projecting a 50% growth ahead.

On the contrary, the coin price entered a renewed correction trend if buyers failed to hold the $20.3 floor. The potential breakdown will liquidate the hasty buyers and accelerate the market selling pressure.

Also Read: Ethereum Price Eyes Key Breakout as Fundamental Global Files $5B SEC Offering

Sahil Mahadik

As a full-time trader with over three years of hands-on experience in the financial markets, I have honed an exceptional proficiency in technical analysis, which is the cornerstone of my daily monitoring of price fluctuations in leading assets and indices. My journey into trading began with a deep fascination for financial instruments, and this curiosity naturally expanded into the ever-evolving world of cryptocurrencies. I am currently contributing to CryptoNewsZ and have also written for Coingape, The Coin Republic and TheMarketPeriodical. I am driven by my passion for the markets and want to explore new opportunities, I analyze emerging trends and strategies to get maximum returns in traditional and crypto markets.Recent Post

All latest news-

Notice: Trying to access array offset on value of type bool in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

Notice: Trying to get property 'term_id' of non-object in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

-

Why Did Bitcoin Price Fall Today and What’s Next?

2 months ago