- Home

- Technical Analysis

- Will Bitcoin Price Hold $110k Floor as Whales Absorb Speculators’ Sell-Off?

Will Bitcoin Price Hold $110k Floor as Whales Absorb Speculators’ Sell-Off?

- Bitcoin’s STH-SOPR dropped below 1 threshold, indicating the speculative traders are selling at a loss.

- Amid the recent Bitcoin price correction, the high-net-worth investors accumulated over 20,061 BTC.

- A double-top pattern in the daily chart could accelerate the market selling pressure for the $110,000 breakdown.

The Bitcoin price witnessed a sharp sell-off of 2.6% during Tuesday’s U.S. market hours. The bearish momentum spread to the broader crypto market and liquidated over $444.3 million in long positions, according to derivative market data provider Coinglass. The falling price has pushed BTC’s short-term back to selling at a loss, signaling a pivotal movement for the current correction trend. Is the coin price heading for the $110,000 support breakdown, or do bulls have an opportunity for a counterattack?

Will Bitcoin Price Hold $110k Floor As Whales Absorb Retail Sell-Off

In the last six days, the Bitcoin price showed a notable pullback from $124,500 to the current trading value of $112,818, projecting a 9.36% loss. The key catalyst for this correction was the U.S. macroeconomic factor that hints at intact inflationary pressure in the country, reducing the possibility of an interest rate cut in September.

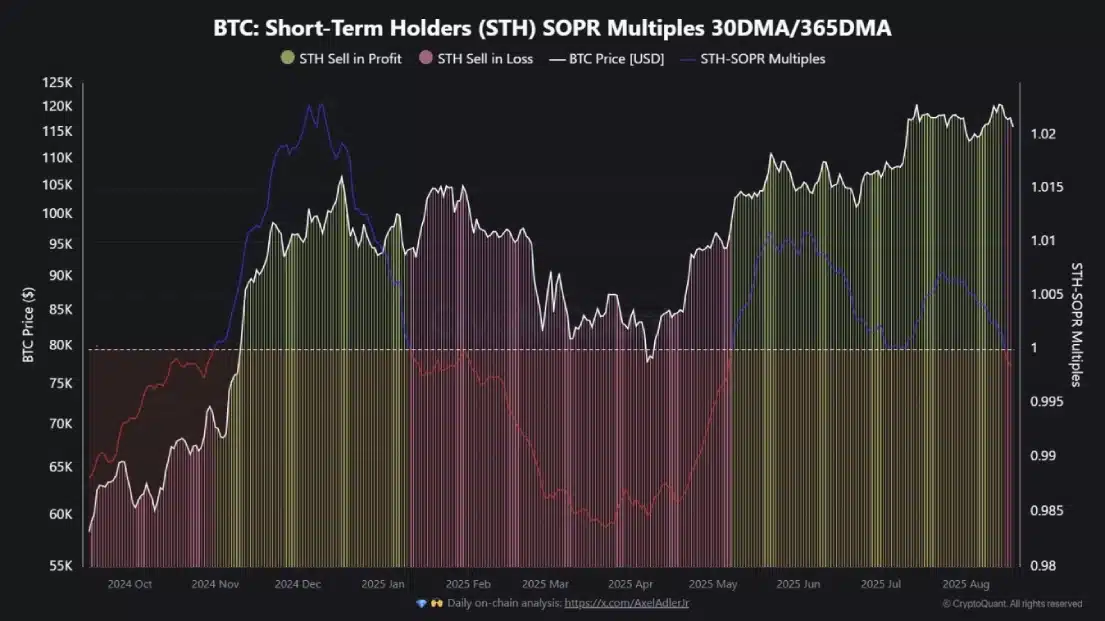

The accelerated downfall pushed Bitcoin’s Short-Term Holder Spent Output Profit Ratio (STH-SOPR) below 1 for the first time since January. The STH-SOPR indicator tracks the coins held for less than 155 days and whether they moved on-chain at a profit or a loss. A reading below 1 indicates that speculative money is selling at a loss, signalling a critical shift in market sentiment.

Historical data shows the BTC’s STH-SOPR last moved below the 1 line during the January 2025 correction, which later resulted in the deepest drawdown of this cycle. After months of consistent profit, the short-term holders are once again realizing losses, projecting two possibilities for Bitcoin in the near future.

A prolonged realized loss from speculative holders will add bearish pressure in the market and extend the price correction.

On the contrary, a temporary dive below 1 threshold will flush the weak hands and attract long-term large investors for a sustained recovery in the next leap.

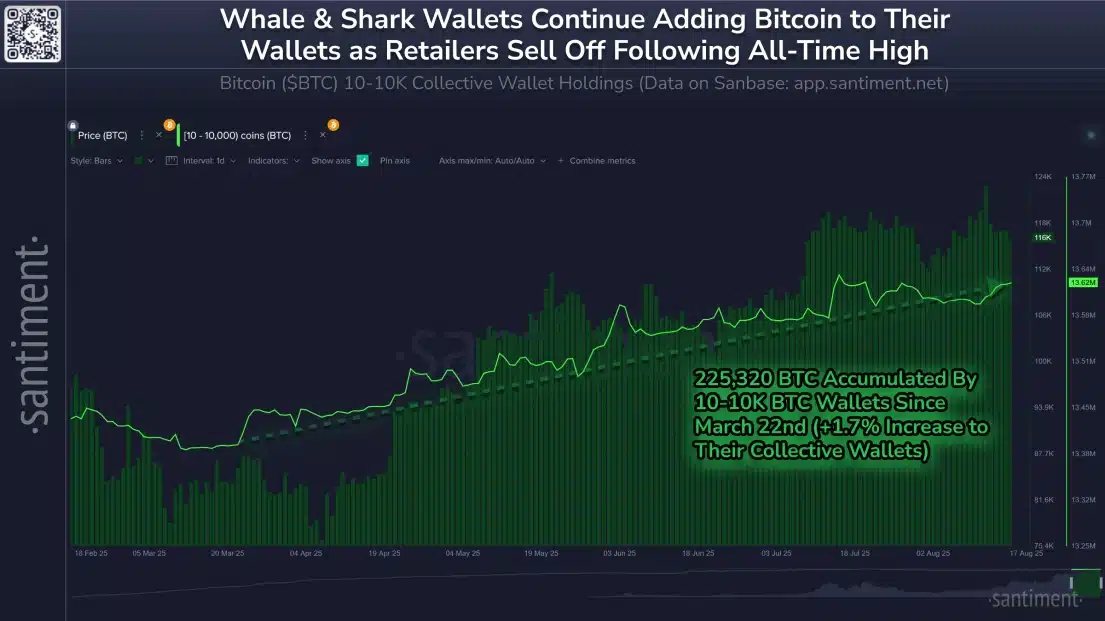

That said, the same correction in BTC price has raised the accumulation trend in whales and sharks.

A recent tweet from analytics platform Santiment revealed that wallets holding between 10 and 10,000 BTC have collectively added 20,061 BTC since last week’s local peak. This buying pressure indicates that high-net-worth investors are interested in the discounted Bitcoin price, accentuating a buy-the-dip sentiment among them.

A broader analysis of this accumulation chart shows these investors have added a staggering 225,320 BTC since March 22, 2025.

Historically, such aggressive accumulation from large investors has been a leading indicator of future price appreciation.

Bitcoin Price Faces Prolonged Correction Amid Double Top Formation

The daily chart analysis of the recent pullback shows a potential formation of a double top reversal pattern. The chart setup is characterized by two key bearish reversals in an ‘M’ shape, indicating intense overhead supply.

The chart setup is commonly spotted in major market tops, leading to a prolonged market correction after its neckline breakdown. The momentum indicator RSI (Relative Strength Index) at 40% also reflects a bearish shift in market sentiment.

Currently trading at $113,141, the Bitcoin price is just 1% short of offering a breakdown below the neckline of $111,919.

With the aforementioned whale buying, the neckline support stands as a crucial foothold for buyers to recuperate the exhausted bullish momentum for next week. If successful, the price trajectory could shift sideways and build sufficient momentum for the next leap.

However, a bearish breakdown below $111,919 with the daily candle closing will accelerate the selling pressure for another 5.8% drop to test the $105,482 mark.

Also Read: Ethereum Price Correction Meets Whale Confidence; Is $5,000 Rally Close?

Sahil Mahadik

As a full-time trader with over three years of hands-on experience in the financial markets, I have honed an exceptional proficiency in technical analysis, which is the cornerstone of my daily monitoring of price fluctuations in leading assets and indices. My journey into trading began with a deep fascination for financial instruments, and this curiosity naturally expanded into the ever-evolving world of cryptocurrencies. I am currently contributing to CryptoNewsZ and have also written for Coingape, The Coin Republic and TheMarketPeriodical. I am driven by my passion for the markets and want to explore new opportunities, I analyze emerging trends and strategies to get maximum returns in traditional and crypto markets.Recent Post

All latest news-

Notice: Trying to access array offset on value of type bool in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

Notice: Trying to get property 'term_id' of non-object in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

-

Why Did Bitcoin Price Fall Today and What’s Next?

2 months ago