- Home

- Technical Analysis

- Ethena Price Trades at $0.64 as Market Awaits Bull Flag Breakout

Ethena Price Trades at $0.64 as Market Awaits Bull Flag Breakout

- A flag formation drives the short-term correction trend in Ethena price, awaiting a potential breakout with renewed recovery.

- ENA futures open interest plunged to $1.22 billion, indicating waning bullish momentum and a potential risk for prolonged price correction.

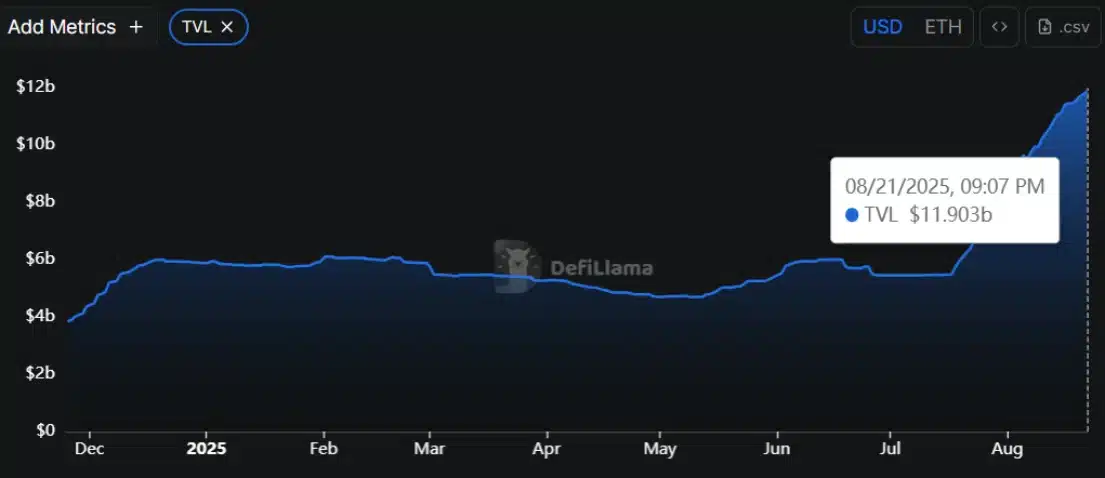

- The total volume locked (TVL) on ENA has recorded a parabolic rally in the last six weeks to reach $11.9 billion, strengthening Ethena’s positioning within the DeFi sector.

ENA, the cryptocurrency of the synthetic dollar protocol Ethena, plunged over 4.3% during Thursday’s U.S. market hours to its current trade at $0.63. The selling across cryptocurrencies continues as investors scale back expectations for a September rate cut. However, the Ethena coin price shows potential for a quick rebound as the total volume locked (TVL) on its network continues to build up higher amid an active whale accumulation. The technical chart further supports the bullish narrative with a potential breakout looming.

Ethena Shows Divergence Between Speculation and Adoption

In the past two weeks, the Ethena price showed a sharp V-top reversal from $0.855 high to its current trading value of $0.628, registering a 25% loss. As a result, the ENA’s market cap plummeted to $4.22 billion. Bitcoin and other leading cryptocurrencies witnessed a similar downturn as expectations for a September rate cut faded.

However, in the short term, the Ethena price trend experienced increased bearish pressure as speculative trading in the derivative market took a major hit. According to the CoinGlass data, the ENA futures over interest has withdrawn from $1.59 billion to $1.22 billion, now accounting for a 23% loss.

This downstick indicates that future traders are closing their open positions in the market either due to forced liquidation or voluntary retreat from speculation amid heightened uncertainty.

Along with declining price, this shift indicates that the speculative interest among market participants is waning and investors are less confident in the asset’s potential price movement.

That said, the total volume locked (TVL) on the Ethena network shows no signs of weakness. According to the DefiLlama data, the TVL value has bounced from $5.4 billion to $11.90 billion now, accounting for a 117% surge in the last six weeks. A swelling TVL typically indicates that investors are committing more assets into the ENA’s DeFi protocol, reflecting both engagement and trust in the network’s utility.

If the trend continues, the stored capital value could support long-term growth, boost protocols, and improve the overall sentiment for ENA.

Ethena Price Poised For Breakout From Flag Pattern

The 4-hour chart analysis of the current correction in Ethena price shows the formation of a bull flag pattern. This bullish continuation setup is commonly spotted within an established uptrend to recuperate the exhausted bullish momentum and offer an upside breakout.

The coin price bounced thrice from the pattern’s upper boundary and twice from the lower boundary, underscoring the strong influence of this formation in guiding price action. Currently trading at $0.645, the Ethena price is just inches away from offering a bullish Breakout from the pattern’s upper boundary.

The momentum indicator RSI (Relative Strength Index) spiked to 44% further accentuating the growing bullish sentiment in the market. A successful flip of the overhead resistance into a suitable support will bolster buyers to drive a 31% surge to hit the $0.856 mark.

However, the anticipated rally could face in-between resistance at $0.474 level, and drive occasional pullback to recoup recovery momentum.

Also Read: Key Resistance To Watch As BNB Coin Price Hits New High

Sahil Mahadik

As a full-time trader with over three years of hands-on experience in the financial markets, I have honed an exceptional proficiency in technical analysis, which is the cornerstone of my daily monitoring of price fluctuations in leading assets and indices. My journey into trading began with a deep fascination for financial instruments, and this curiosity naturally expanded into the ever-evolving world of cryptocurrencies. I am currently contributing to CryptoNewsZ and have also written for Coingape, The Coin Republic and TheMarketPeriodical. I am driven by my passion for the markets and want to explore new opportunities, I analyze emerging trends and strategies to get maximum returns in traditional and crypto markets.Recent Post

All latest news-

Notice: Trying to access array offset on value of type bool in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275

Notice: Trying to get property 'term_id' of non-object in /home/bostoncaracciden/forexnewslive.co/wp-content/plugins/wpsmart_siren/widgets/featured_post_by.php on line 275